I know, we were all supposed to buy Bitcoin a few years ago and by now be millionaires. We would sit around all day adding to our holographic NFT collections and shooting to the moon with the latest social media fueled short squeeze stock. How about taking a look at Berkshire Hathaway though?

How Things Come Back to Fundamentals

Well, that did not happen for 95% of us. Yeah, a few of us, Money Vikings included made some money off crypto, experimented with NFT’s and took a ride on a couple meme stocks. But the real money was in grandpa style investing!

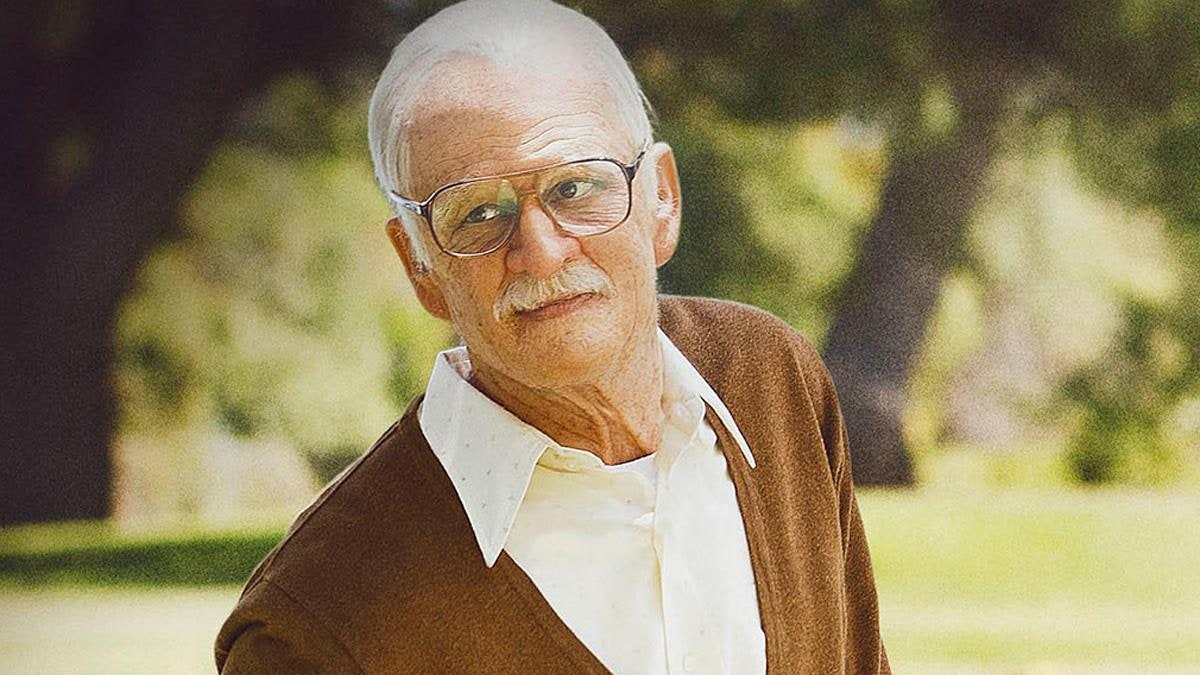

Maybe Grandpa Buffett knows a few things

BRK-B

I am a proud investor in Berkshire Hathaway BRK-B shares. And when I look back over the last 10 years there were many shiny new investments that made no money and lost value. Then I get to the line item in my portfolio where BRK-B sits and it has a nice large bright green number that represents the gains and equity.

Happy Birthday Grandpa Buffett

Here is one of my earlier reviews of BRK-B stock.

5 Interesting Things About Berkshire Hathaway

Here is a snapshot of grandpas investment holding company and why it will rule for many many decades to come. Berkshire Hathaway is a conglomerate holding company, which means it owns a diverse portfolio of companies across various industries. Here are 5 interesting things about Berkshire Hathaway:

- It’s one of the largest companies in the world: As of 2021, Berkshire Hathaway has a market capitalization of over $650 billion, making it one of the largest publicly-traded companies in the world. It’s also consistently ranked among the most admired companies in the world by Fortune magazine.

- Warren Buffett is the CEO: Warren Buffett is one of the most famous investors in the world and has been the CEO of Berkshire Hathaway since 1965. He’s known for his long-term investment strategy, value investing philosophy, and his personal frugality.

- Its portfolio includes a wide range of companies: Berkshire Hathaway owns over 60 companies, including some well-known brands like Geico, Dairy Queen, Duracell, and Fruit of the Loom. Its holdings also extend beyond consumer goods and services to include insurance, finance, energy, and technology.

- It has a unique approach to acquisitions: Instead of buying companies and then selling them for a profit, Berkshire Hathaway tends to acquire companies with the intention of holding onto them for the long term. This has allowed it to build a diverse and resilient portfolio of companies that generate steady cash flows.

- It has a successful track record of generating returns: Over the past 50 years, Berkshire Hathaway’s stock has significantly outperformed the broader market. This is largely due to the skill of Buffett and his team in identifying undervalued companies and investing in them for the long term. In fact, $1,000 invested in Berkshire Hathaway in 1965 would be worth over $22 million today

The Shiny New Things

I am all for progress, but sometimes the shiny new things we see are just distractions on our road to wealth. You will need to decide for yourself what these things are. But I can say for certain that great companies and great real estate that actually bring in money and provide real value to customers have a very long and prosperous future ahead.

Stay the Course

I am staying the course and investing in solid long term investments like BRK-B. Yes, I may still dabble in crypto, NFT’s and whatever the next big thing may be, but this will always be more speculative as I enjoy the long term solid gains the way Grandpa invests.